How does Garden work?

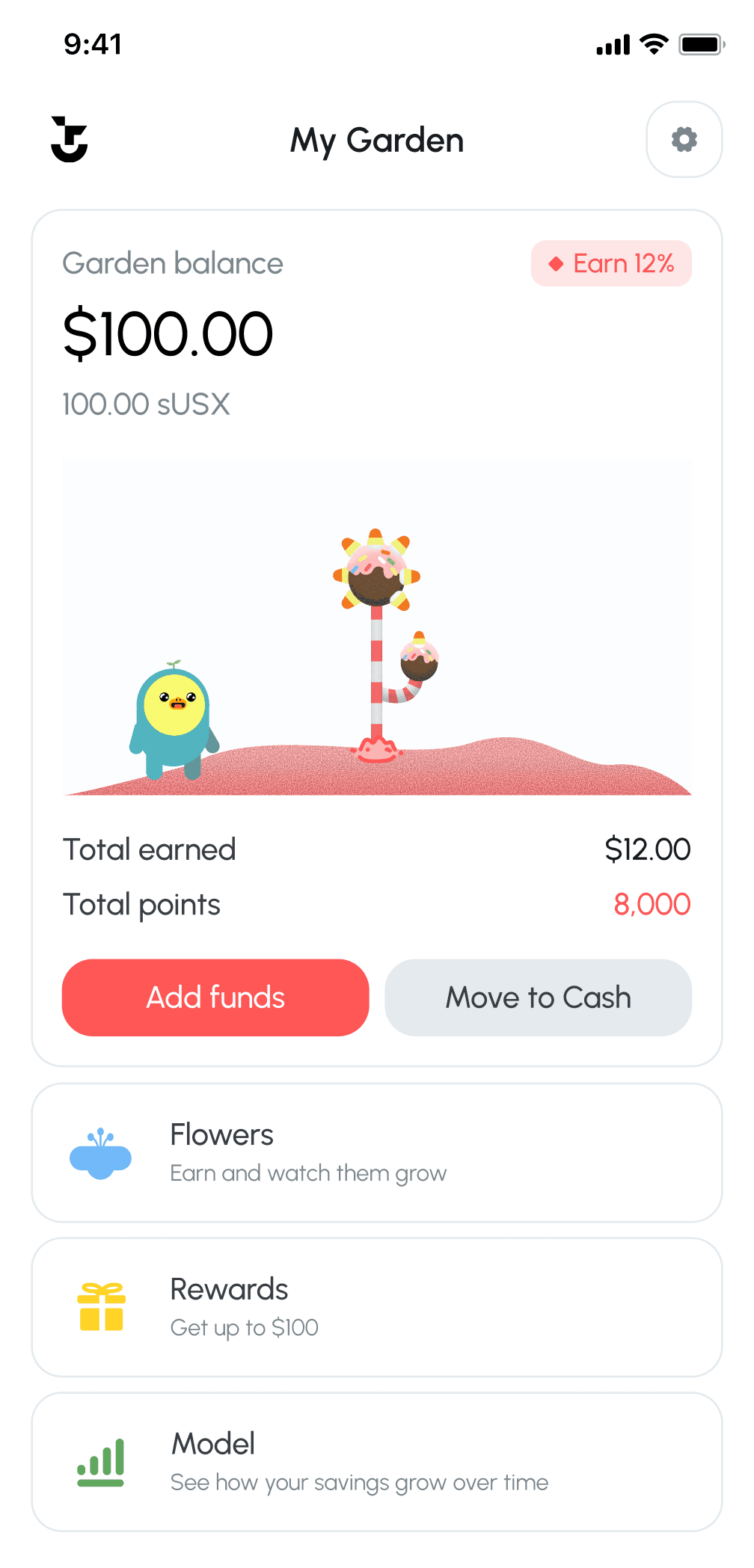

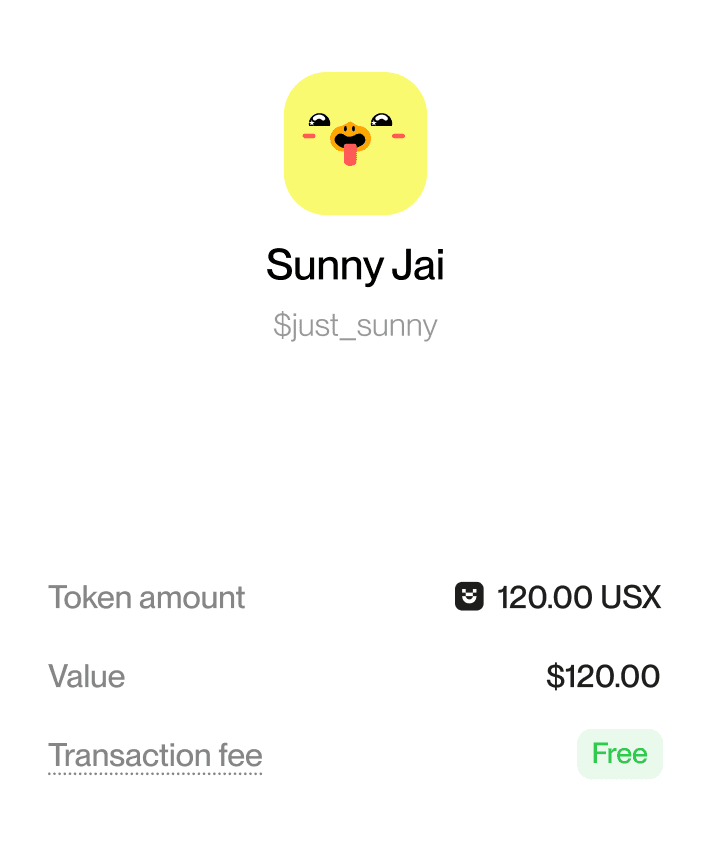

Garden turns your dollars into a digital dollar called USX. Unlike Bitcoin, USX is always worth $1 US dollar.

And USX is backed by USDC, which, in turn, is backed 1:1 by real money in the bank, so it’s a safer starting point for earning in crypto. When you deposit USX into Garden, you’ll receive a token called sUSX. It’s your proof of deposit.

Then, we put it to work in two ways:

1. Onchain strategies that earn rewards from crypto while limiting risk, by making sure changes in price don’t affect your overall return.

2. Partner investment firms with strong track records that invest in strategies that balance against crypto market swings.

Together, these generate returns that go straight to you, upt to 15% a year on your savings.

How does Garden make crypto safer?

Most crypto losses happen from simple mistakes: forgotten passwords, compromised accounts, and bad links.

We fix that with Privy, which lets you log in using email or phone and recover your account in case anything goes wrong.

And, it’s all self-custodied. That means you own your account and can recreate it anytime with a secret key you control.

So, even if Garden doesn’t exist, your funds will never disappear.

How does Garden keep funds safe?

We’ve done the work to make sure the risk-to-return ratio actually makes sense.

To protect against market swings, we use balanced trading strategies that perform whether prices go up or down.

And, if things ever do go wrong, 50% of fees go to an insurance fund built to cover potential losses.